Free Tax USA - Simple Path To Easy Filing

Getting your yearly financial paperwork sorted can feel like a big job, but finding a way to do it without spending money can make a huge difference, so you know. Many folks look for help with their taxes, and it's a good thing there are options that won't cost you anything at all. This means more of your hard-earned money stays right where it belongs: with you.

One such option that has been helping people for a good while now is free tax usa, offering a straightforward way to handle your federal and state tax reports. It's a service that aims to make the process as simple as can be, allowing you to get your documents ready and sent off from the comfort of your own home, you know. They have built their service around the idea that everyone should have access to clear and cost-free tax preparation.

This service really does what its name suggests, providing a completely free way to get your federal taxes submitted, and often your state taxes too, as a matter of fact. It’s set up to be a safe and easy experience for many people, helping them figure out their tax situation and work towards getting the most money back possible. We'll talk more about how it all works and who it's for in the sections ahead.

Table of Contents

- What Makes Free Tax USA a Smart Choice?

- Getting Started with Free Tax USA

- Is Free Tax USA Truly Free for Everyone?

- Who Can Use Free Tax USA Without Cost?

- How Does Free Tax USA Help You Get Your Best Refund?

- Understanding Support for Free Tax USA Filers

- What About Filing State Taxes with Free Tax USA?

- The History Behind Free Tax USA

What Makes Free Tax USA a Smart Choice?

When it comes to sorting out your yearly money reports, many people look for something that is both easy to use and doesn't add to their expenses. Free tax usa stands out because it offers a way to prepare your federal income taxes online at absolutely no charge, which is a really big deal for many households. This means you can get your main tax paperwork done and sent off without having to pay for the software itself, or for the act of sending it in, too it's almost a given.

The whole idea behind free tax usa is to make the tax reporting process as simple as possible. You can get your federal and state tax returns ready right from your computer or phone, which is quite convenient. It takes away the need for paper forms and the trip to a tax preparer, letting you handle things on your own schedule, as a matter of fact. This kind of flexibility is something many people appreciate, especially when life gets busy.

A key part of what makes free tax usa appealing is its focus on being straightforward. The design of the online system helps guide you through each step, making sure you put in all the necessary details without feeling overwhelmed. It's built to be very user-friendly, so even if you're not a numbers person, you can still feel confident about getting your taxes done correctly, you know.

Getting Started with Free Tax USA

Beginning your tax preparation with free tax usa is a pretty simple process, actually. You just need to sign in to your account, or create one if you're new, and then you can start getting your federal and state tax returns ready for submission. The system is set up to walk you through the various sections, prompting you for the information it needs to put together your official documents, so.

One of the handy features is how you can get your documents into the system. If you have paper forms or statements, you can simply snap a photo of them with your phone or upload a digital file directly. This really helps cut down on the time and effort it takes to input all your financial details, making the whole experience a little less tedious, you know.

The service also helps you prepare your federal and state income taxes online, which means all the calculations and form filling are handled by the software itself. You provide the numbers, and the system does the heavy lifting, putting everything in the right place according to current tax rules. This helps ensure accuracy and reduces the chance of errors that could slow down your refund, or even create other issues, as a matter of fact.

It's worth noting that free tax usa is an IRS partner site, which means it's part of the IRS Free File Program. This partnership adds a layer of trust and reliability, as it indicates the service meets certain standards set by the tax collection agency itself. You can also use free file fillable forms through this program if your situation is very straightforward, which is another option for many people.

Is Free Tax USA Truly Free for Everyone?

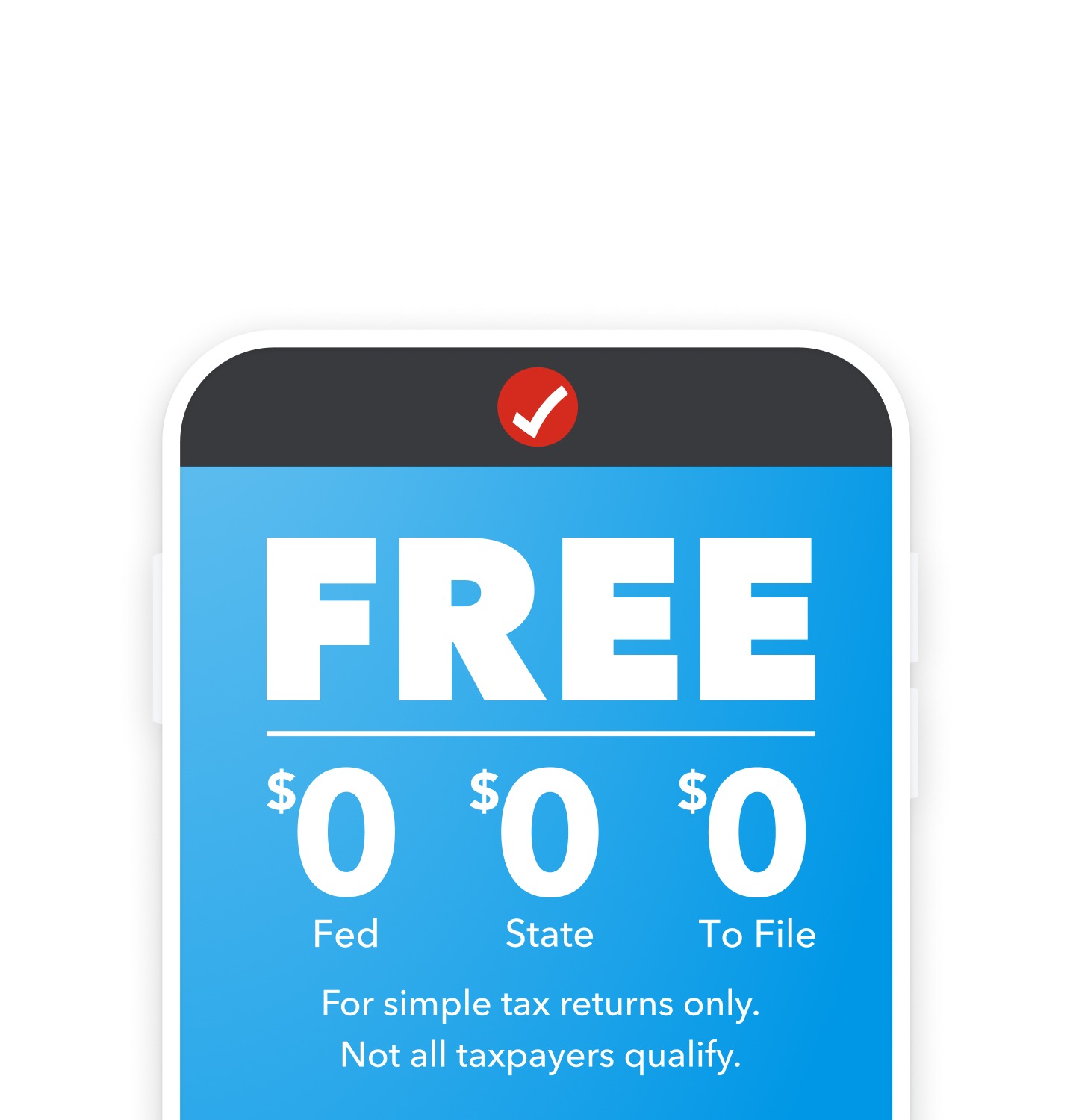

A common question people have about any service that claims to be "free" is whether it really applies to everyone, or if there are hidden catches. With free tax usa, the federal tax filing is indeed 100% free for everyone who uses it directly. This means you won't pay a cent to prepare and send in your main federal income tax report, which is quite a benefit for many households, you know.

However, when it comes to state tax reports, the situation can be a little different. While the federal filing remains free, there might be a small charge for preparing and submitting your state tax report, depending on your particular situation and the state you live in. It's always a good idea to check the specific details for your state as you go through the process, just to be sure, as a matter of fact.

The goal of free tax usa is to make tax reporting accessible and affordable for as many people as possible. They aim to be the easiest way to file your federal and state taxes online, and for a great many people, they succeed in providing a truly cost-free way to handle their yearly financial paperwork, so.

Who Can Use Free Tax USA Without Cost?

While the federal filing with free tax usa is free for everyone, there are specific situations and income levels that qualify you for other free tax filing options, some of which might include free state tax filing. For instance, taxpayers, especially those with lower or middle incomes, or those whose tax situations are quite simple, can often file for free through various programs, you know.

One common way to qualify for free federal and sometimes free state tax filing through IRS partner sites is if your adjusted gross income, or AGI, was $84,000 or less. If your income falls within this range, you should look at what each trusted partner offers to make sure you meet their specific requirements for a free federal return. Some of these trusted partners might even include a free state tax return as part of their offering, which is really helpful for many people, actually.

It's important to remember that these free options are often aimed at those who have simpler tax situations, perhaps using just a basic Form 1040. This means if you have a lot of complex deductions, investments, or business income, you might find that the free versions of some software, like the TurboTax Free Edition mentioned in some places, only cover very basic returns. They might not include schedules beyond certain common ones like the earned income tax credit, child tax credit, or student loan interest deductions, so that's something to keep in mind.

How Does Free Tax USA Help You Get Your Best Refund?

One of the main reasons people go through the process of filing their taxes is to get back any money they are owed, or to make sure they don't pay more than they should. Free tax usa helps you work towards receiving your maximum refund by guiding you through the process and making sure you account for all the details that could affect your tax outcome. The online system is set up to ask you questions that help uncover potential deductions or credits you might be eligible for, you know.

The system keeps up with the latest tax rules and forms, using current IRS and state 2024 tax rates and forms for the filing year. This means that when you prepare your 2024 tax returns on free tax usa, you can be confident that the calculations are based on the most up-to-date information. This accuracy is a big part of getting the money you deserve back from the government, or paying the correct amount, as a matter of fact.

The ease of use also plays a role in helping you secure your best refund. When a system is easy to understand and follow, you're less likely to miss important steps or overlook information that could benefit your tax situation. Free tax usa aims to be the easiest way to file your federal and state taxes online, and this simplicity helps ensure that you can complete your return thoroughly and accurately, which is pretty good.

Understanding Support for Free Tax USA Filers

Even with a straightforward system, questions can come up when you're doing your taxes. Free tax usa offers ways to get your questions answered, primarily through email and an account message center. This means you can send in your specific queries and get a written response, which can be quite helpful if you need to refer back to the advice later on, or just need a little guidance, you know.

Beyond the direct support from free tax usa, there are other sources of help available for people preparing their federal tax returns, especially those who might need a bit more assistance. The IRS itself offers free help through programs like Volunteer Income Tax Assistance, often called VITA, and Tax Counseling for the Elderly, known as TCE. These programs provide free tax help to people who qualify, such as those with low to moderate incomes, people with disabilities, and older adults, which is a great resource.

Additionally, military members and their families can often get free tax filing help through MilTax, which is another program designed to support specific groups of taxpayers. These options show that there are many ways to file your taxes for free if you meet certain requirements, and they provide valuable assistance for those who might feel a bit unsure about doing their own taxes, so.

What About Filing State Taxes with Free Tax USA?

While the focus is often on federal taxes, almost all states also require their own income tax reports, and getting these done can sometimes add another layer of work. Free tax usa allows you to prepare and file both your federal and state income taxes online, which means you can handle both sets of paperwork in one place. This saves you the trouble of going to a separate service or using different software for your state taxes, you know.

As mentioned earlier, while federal filing is completely free, there might be a small charge for state tax filing with free tax usa. This varies by state, and it's a detail you'll want to confirm as you get your state return ready. Even if there's a small fee, it's often much less than what you might pay through other services, making it a very cost-effective choice for many people, as a matter of fact.

The online software used by free tax usa is kept up-to-date with current state tax rates and forms for the filing year, just like it is for federal taxes. This ensures that your state return is prepared accurately and in line with your state's specific rules, which is pretty important for a smooth filing experience. Knowing that the system uses the correct forms and rates can give you peace of mind as you complete your state tax paperwork, so.

The History Behind Free Tax USA

It's often helpful to know a little about the background of a service you're trusting with your important financial details. Free tax usa is a tax preparation service that truly lives up to its name, providing tax preparation and filing at no charge for federal returns. It has been around for a while, having been founded in 2001 by a certified public accountant, or CPA, which means it has roots in professional accounting knowledge, you know.

The fact that it was started by a CPA suggests a foundation built on a deep understanding of tax laws and financial reporting. This kind of background can give users confidence that the service is designed with accuracy and compliance in mind. It shows a commitment to helping people manage their tax duties effectively and without unnecessary cost, which is a good thing.

Over the years, free tax usa has continued to offer its service, making it a consistent option for those looking to file their taxes without spending money. It has maintained its core promise of being safe, easy, and having no cost to you for federal filings, which has helped it become a well-known name in the world of online tax preparation for many people, as a matter of fact.

Free Tax Usa 2025 Edition - Emily Hong

Free Tax Usa 2024 - Halie Leonora

Free Tax Usa 2024 - Darla Emeline