LPL Financial - Your Partner In Wealth Growth

Finding good support for your money matters, or even just figuring out how to manage things, can feel like a big job. People often look for help with their financial plans, whether that means saving for retirement, handling their investments, or simply learning more about how money works. There are companies out there that work to make this process clearer and more approachable for everyone involved, so it's almost a given that you might have heard of some of them.

One company that comes up often in these conversations is LPL Financial. They have a big role in helping independent financial advisors across the country, which in turn helps many families reach their money goals. This company provides tools and support that advisors use to give good advice, making it a bit easier for people to get the financial guidance they need. You know, it's really about making sure advisors have what they need to help you.

This piece will give you a closer look at LPL Financial, showing you what they do, who they help, and how they operate. We will talk about their services for advisors and investors, what kind of information they offer, and where you might find them. It's like your quick guide to understanding a bit more about this company and how it plays a part in the money world, really.

Table of Contents

- Who is LPL Financial, anyway?

- How Does LPL Financial Help Advisors and Their Clients?

- Getting Connected with LPL Financial

- What Kind of Support Does LPL Financial Offer?

- LPL Financial in the News

- Is LPL Financial the Right Fit for You?

- Meeting an LPL Financial Advisor

Who is LPL Financial, anyway?

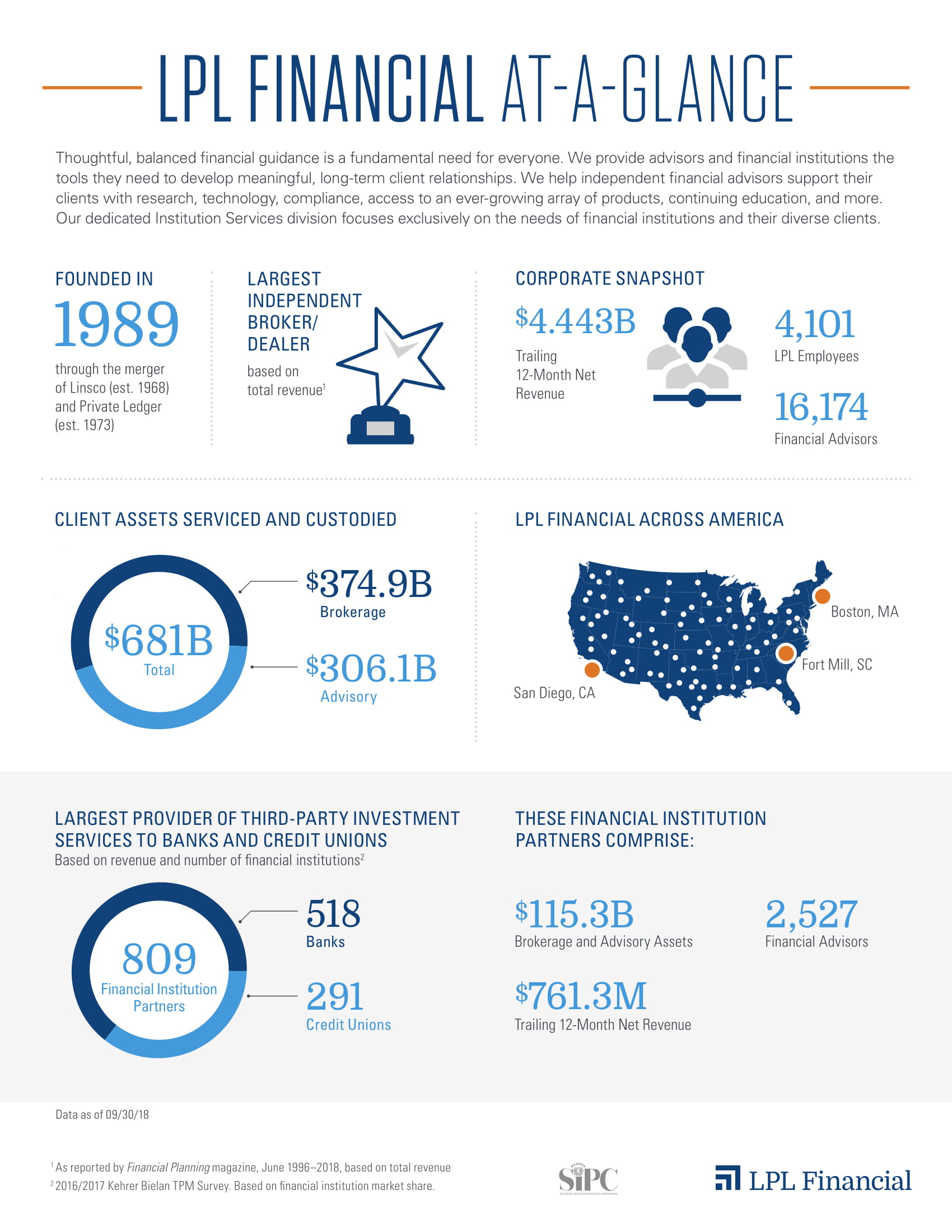

LPL Financial stands out as a top company that helps independent financial advisors all over the United States. They focus on giving these advisors the tools and resources they need to serve their own clients well. This setup means the company works to support the advisor, rather than the other way around, which is a pretty unique way of doing things, in some respects. This idea of the firm serving the advisor was actually how LPL Financial began.

When you think about financial service companies, LPL Financial is considered one of the leaders. They are also known as the largest independent broker/dealer in the country. This means they provide a place where independent advisors can offer investment services without being tied to a big bank or a single product line. Their widespread presence and reputation make them a significant player in the financial support field, more or less.

The company and its connected groups offer a range of things to help advisors do their work. This includes things like special computer programs, ways to learn new skills, and even detailed studies on different markets. All of these elements are meant to give advisors a solid base from which to help people with their money. It's like they give advisors a whole set of useful things to work with, arguably.

How Does LPL Financial Help Advisors and Their Clients?

LPL Financial provides a lot of things that can help both advisors and the people they advise find success. They offer technology and different kinds of support that advisors use to guide their clients through various money matters. This assistance is designed to make the process smoother for everyone involved, so it's quite helpful for those who are looking for good financial advice. This really makes a difference for advisors, you know.

The company helps advisors give clear and unbiased advice to many, many American families. These families are often looking for ways to handle their money, plan for their later years, create a budget for their spending, and manage their investments. LPL Financial gives advisors the necessary backing to provide these important services, making it possible for people to get guidance that fits their specific situations, basically.

From their base in San Diego, California, LPL Financial works with independent financial advisors and financial organizations. They supply these groups with the computer systems, research materials, ways to process transactions, and rules for staying compliant with regulations. This comprehensive package helps advisors focus on what they do best, which is helping people with their money, actually. It's like a complete support system for financial professionals.

Getting Connected with LPL Financial

For advisors and investors who work with LPL Financial, there are special online places to go for information. These online spots include a portal for advisors who are new to LPL, a system called ClientWorks, and a summary of client relationships. Investors, on the other hand, can use a separate view called Account View to check on their holdings. These online tools make it pretty simple to access important information, by the way.

If you are looking for a physical location of an LPL Financial firm, you can often find one in your local area. The company provides ways to locate these offices, so you can get directions or even connect directly with a financial advisor who works there. This makes it easier for people to find a person they can talk to about their money questions, rather than just relying on online information. It's about making personal connections, you know.

The ability for advisors to work independently and have a sense of ownership over their practice is a key part of the LPL Financial approach. This independence allows advisors to dedicate their time and effort to their clients without a lot of outside interference. It means they can focus on what matters most: helping you with your financial needs, which is quite important for many advisors. This really gives them freedom, you see.

What Kind of Support Does LPL Financial Offer?

LPL Financial is also here to help teach people about the basic ideas behind managing money. They want to make sure you have a good grasp of how financial things work, which can be really helpful for making smart choices with your own money. This educational effort is part of their broader goal to assist people in understanding their financial world, so it's a good place to start if you are new to these ideas. They try to make it approachable, very.

They also aim to help you learn more about who they are as a company. This means providing information that gives you a clearer picture of their values and how they operate. Knowing more about the company behind the services can give you a better sense of trust and comfort when working with an advisor connected to them. It's like getting to know a bit about the people you are dealing with, in a way.

For those who like to keep an eye on market trends, LPL Financial offers quick and simple ways to get information about how the market is performing. This means you can get data on stocks, bonds, and other investments without a lot of fuss. Having this kind of information readily available can help both advisors and investors stay informed about what is happening in the financial world, which is pretty useful, actually.

LPL Financial also has various roles within its own operations, including positions in finance and accounting. These internal teams support the overall work of the company, making sure everything runs smoothly behind the scenes. So, while they help advisors and investors, they also have their own business to run, which involves many different types of jobs. This helps keep everything organized, you know.

LPL Financial in the News

News reports have mentioned that LPL Financial, a company that provides wealth management services, was planning to reduce its staff. Specifically, about 70 people in San Diego were scheduled to be let go starting in August, as the company had announced earlier this month. In parallel with this, there was also talk of another similar round of changes happening around the same time. This kind of news can be a bit concerning for those involved, naturally.

It is worth noting that companies sometimes make adjustments to their workforce for various reasons, which can include changes in business needs or strategies. This information about staff changes comes directly from public announcements made by the company. It is a part of the overall picture of how a large organization like LPL Financial manages its operations and adapts to different circumstances, you know. Such events are often part of a company's ongoing business cycle, in some respects.

While these kinds of announcements can be difficult, they are also a part of how large businesses operate and respond to the economic climate. The company's overall standing as a major financial service provider remains, even with these internal changes. It is just one piece of information that helps paint a complete picture of LPL Financial and its activities, which is important for those who follow the company. This is a common occurrence for many businesses, apparently.

Is LPL Financial the Right Fit for You?

If you are thinking about working with LPL Financial, either as an advisor or an investor, it helps to look closely at what they offer. This includes their different services, how they advise clients, any fees they might have, and the smallest amount of money you might need to start an account. Understanding these things can help you figure out if they are a good match for your own needs and goals, so it's a good idea to get all the details. It's like doing your homework before making a big decision, really.

It's also helpful to consider the good points and any downsides of working with the company. Knowing these things can help you make a well-thought-out choice. For instance, the company was founded on the idea that it should support the advisor, which is a strong positive for independent financial professionals. This principle means the company aims to put the advisor's needs first, which can be a big draw for many, actually. It's a pretty unique way of doing business, you know.

LPL Financial holds a leading position in the markets it serves. This means they are often at the forefront of financial services for independent advisors. Their standing as the largest independent broker/dealer in the United States also shows their significant presence and influence in the industry. This position suggests a certain level of experience and reach, which can be appealing to those looking for a well-established partner. They are quite a big name, you see.

Meeting an LPL Financial Advisor

When you look for financial advice, you might come across individuals who work with LPL Financial. For example, Stephen Kuczynski is mentioned as a financial advisor who is associated with the company. The services he offers, both for buying and selling investments and for giving advice, are provided through LPL Financial. This company is also a registered investment advisor, which means it follows certain rules and guidelines when giving financial guidance. This is pretty standard for financial professionals, basically.

This connection means that when you work with an advisor like Stephen, their operations are supported by LPL Financial's systems and compliance frameworks. It gives a layer of structure to the advice you receive and the transactions you make. Many advisors choose to work with independent companies like LPL Financial because it allows them to run their own practices while still having access to a broad range of support and resources. It's like having a big team behind you, you know.

If you are thinking about getting financial advice, reaching out to an advisor who works with LPL Financial could be an option. You can find firm locations and contact information to get started. This allows you to speak directly with someone who can help you understand your financial situation and options. It's about making that first step towards getting personalized guidance, which is quite important for many people, really.

LPL Financial is a significant player in the financial support world, particularly for independent advisors. They provide technology, research, and different kinds of support to help advisors serve their clients. This includes helping with wealth management, retirement planning, and general financial advice. They also offer ways for advisors and investors to access their accounts and market data. The company has a large presence as an independent broker/dealer and focuses on supporting the advisor's practice. They also provide educational resources and have various internal roles, though they have also seen staff changes. People can find their firm locations and connect with advisors who work with them to get help with their money questions.

LPL Financial by Dave Burgess | Studio 616 Photography

LPL Financial | Fero Financial

LPL Financial | One Oak Wealth Management