Net Credit - Your Financial Support Choices

Sometimes, life throws financial curveballs, and you might find yourself needing a little extra help to keep things moving. Maybe it's an unexpected bill, a home repair that just can't wait, or something else entirely. In those moments, finding a quick and dependable way to get some funds can make a world of difference, you know? That's where a place like Net Credit steps in, offering online ways to get money that are meant to help you get back on your feet financially. They aim to be a source of support when you need it most, actually, helping you handle those immediate money needs.

When you are looking into options for personal money support, it's pretty normal to want something that is both quick and easy to work with. Net Credit, as a financial company that works online, has been around since 2012, so, they focus on providing personal loans and lines of credit. They offer amounts that can go up to $10,000, or even more in some situations, which is quite a range for many people seeking a little financial push. Their goal, in a way, is to make getting funds simpler for those who might not have other quick choices.

It's always a good idea to know what you are getting into, especially with financial products, and that's exactly what we are here to talk about. We will look closely at what Net Credit offers, how it might fit your personal money situation, and what you should think about before making any choices. This way, you can figure out if their services are a good fit for what you need right now, or perhaps in the future, as a matter of fact. We will cover the good points and the things you should be aware of, so you can make a choice that feels right for you.

Table of Contents

- What is Net Credit Really About?

- How Can Net Credit Help You Get Ahead Financially?

- Checking Your Net Credit Options Without a Score Hit

- Are Net Credit APRs Something to Worry About?

- Who Might Find Net Credit a Good Fit?

- What Makes Net Credit Stand Out?

- Important Details for Net Credit Users

- Considering Net Credit for Your Future Money Needs

What is Net Credit Really About?

Net Credit is an online company that gives out personal loans and also offers credit cards, which is pretty handy for many people. It got its start in 2012 and is actually a part of Enova International, a bigger company. They mainly focus on helping people get personal loans and lines of credit. These are types of money support that can be quite useful for different life situations, whether it is a planned expense or something that pops up unexpectedly. They operate completely online, which makes getting to their services fairly straightforward for most people, you know.

When we talk about the money amounts available from Net Credit, it's interesting to see the range. They offer personal loans that can go from as little as $500 up to $20,000, depending on where you live. This means that the exact lowest and highest amounts you can get might be different based on your state, which is something to keep in mind. For most states, though, personal loans typically fall within a $1,000 to $10,000 range. Additionally, they also have personal lines of credit that can go up to $4,500, providing another way to access funds when you need them, so.

It's worth noting that Net Credit is known as an online lender that often works with people who might have had some trouble with their credit history in the past. This means that if your credit score isn't as high as you'd like, they might still be an option for you, which is pretty helpful for some folks. However, there are limits to how much money they will lend, usually up to about $10,500, and again, this can change based on where you are located. Their aim is to provide a way for people to get money even when traditional banks might say no, which is a big deal for many, in a way.

How Can Net Credit Help You Get Ahead Financially?

When you find yourself needing money rather quickly, Net Credit aims to be a dependable choice for online loans. They try to make it easy to get funds that can help you move forward with your money situation. The idea is that if you need a sum of money for something important, they can help you get it into your account without a lot of waiting around. This can be quite a relief when time is of the essence, as a matter of fact. They focus on being a source you can count on when those unexpected money needs pop up.

One of the aspects that many people appreciate about Net Credit is the speed at which they can get money to you. If you are approved for a loan, they can often get up to $10,000 sent to your bank account as soon as the next business day. This kind of quick access to funds can be very important for things like urgent repairs, medical bills, or other situations where waiting isn't an option. It's designed to give you that immediate financial push when you really need it, which is useful, really.

The company believes it can be quite helpful for those who meet their requirements. They look at your situation and decide if their services are a good fit for you. This means they are trying to offer a way for people to get financial support when they might otherwise struggle to find it. So, if you're someone who qualifies for their offerings, Net Credit wants to be a beneficial choice for your money needs, providing a path to handle expenses that come up, you know.

Checking Your Net Credit Options Without a Score Hit

A really common worry when looking for any kind of money help is what it might do to your credit score. It's a big deal for many people, since that score can affect so many things. What's good about Net Credit is that you can check to see if you are able to get up to $10,000 without it making any mark on your credit score. This means you can find out your options without any risk to your financial standing, which is pretty reassuring, so.

This "no credit score impact" check is a nice feature because it lets you explore your possibilities without commitment. You can see what you might qualify for, get a sense of the terms, and then decide if it's the right path for you. It takes away some of the pressure that usually comes with applying for money. It's like being able to try something on before you buy it, which is helpful, you know.

Are Net Credit APRs Something to Worry About?

When you are looking at any kind of loan, the Annual Percentage Rate, or APR, is a really important number to pay attention to. Net Credit loans do come with what are considered rather high APRs. In some states, these rates can go up to 99.99%, which is a pretty significant number. It's something you definitely need to be aware of when considering their services, as a matter of fact, because it affects the total cost of borrowing money.

However, it's also worth putting those APRs into perspective. While they are on the higher side, they are typically lower than what you might find with payday loans. Payday loans are often one of the very few options available to people who have had some credit trouble, and their rates can be incredibly high. So, in that comparison, Net Credit can be a somewhat less costly choice for individuals with a less-than-perfect credit history, which is something to consider, in a way.

The reason smaller loans with higher interest rates are often more accessible is that they carry more risk for the company lending the money. Because of this added risk, the cost of borrowing tends to be higher. This is a common situation across the financial world, and it explains why Net Credit's rates are what they are. It's a trade-off: higher rates for more accessibility, especially for those who might not qualify for other types of money support, you know.

Who Might Find Net Credit a Good Fit?

Net Credit is set up to help specific groups of people, particularly those who might have had some difficulties with their credit standing. If your credit report shows some bumps, and traditional banks or lenders are turning you away, Net Credit could be a place to look. They specialize in offering personal loans to people who have what is often called "damaged credit." This means they are willing to take on a bit more risk to help those who need it, which is pretty unique, you know.

On the other hand, if you are someone who has a good credit score and can easily get loans from typical banks or credit unions, you should probably look elsewhere. These traditional lenders usually offer much lower interest rates and better terms because you present less risk to them. So, for those with strong credit, Net Credit's offerings, while helpful for others, might not be the most cost-effective choice. It's all about finding the right fit for your personal money situation, as a matter of fact.

Ultimately, figuring out if a Net Credit loan is right for you comes down to your specific needs and your financial background. If you need funds quickly, have had some credit issues, and understand the higher costs involved, then it might be a sensible option. It's about weighing the speed and accessibility against the higher APRs to see if it makes sense for your current situation, you know. They aim to be a solution for a particular group of people seeking money support.

What Makes Net Credit Stand Out?

Net Credit tries to set itself apart in the world of personal loans by offering a few unique things that are meant to make the experience better for the person borrowing money and help with their overall money well-being. They aren't just another place to get a loan; they try to add some extra value to the process. This focus on the person's experience is a key part of what they do, which is interesting, really.

One way they show this is through how they are reviewed by others. For example, the WalletHub rating for Net Credit is put together from various reviews. These reviews give a picture of what real people think about their services, which can be helpful when you are trying to decide if they are a good choice for you. It gives you a sense of how they perform in the eyes of their users, so.

They offer fast funding for smaller personal loans and lines of credit online. This speed is a big part of their appeal. When you are in a situation where you need money quickly, having a place that can get funds to your account the next day can be a huge advantage. It's this quick turnaround time that often makes them a consideration for people facing urgent money needs, you know.

Important Details for Net Credit Users

When you visit the netcredit.com website, whether you are just signing in or logging on, it's important to know something about how they work. By using their site, you are acknowledging and agreeing that Net Credit might use certain kinds of technology, specifically something called "session replay technologies." This means they can, in a way, see how you interact with their website, which is pretty standard for many online services these days, as a matter of fact.

If you want to get more information about how they use these technologies or anything else related to your privacy and how they handle your data, they encourage you to check out their terms of use. This document is where all the fine print is, and it's always a good idea to read it carefully. It helps you understand exactly what you are agreeing to when you use their services, which is pretty important, you know.

Considering Net Credit for Your Future Money Needs

Looking ahead, perhaps to 2025, it's always good to consider if Net Credit might be a suitable option for your money needs. The financial world is always moving, and having a clear idea of your choices is very helpful. So, taking the time to figure out if a Net Credit loan is the right fit for you, both now and in the near future, is a smart step, you know.

To get a full picture, you can look into reviews of Net Credit personal loans. These reviews often cover important things like what features they offer, what benefits you might get, the rates they charge, any fees involved, and much more. Going through this kind of information helps you get a complete picture, allowing you to make a choice that feels truly informed and right for your specific situation, as a matter of fact. It's about getting all the facts before you decide.

Net Credit offers personal loans online with fast ways to get money, especially for smaller personal loans and lines of credit. This speed and accessibility are key aspects of their service. They aim to be a quick solution for those needing a bit of financial help, making it easier to get funds when time is of the essence. This focus on quick, accessible money is a big part of their appeal, you know.

Final Summary: This article has explored Net Credit, an online lender providing personal loans and lines of credit since 2012. We looked at how they offer fast funds, sometimes as quickly as the next day, and allow eligibility checks without impacting your credit score. The discussion covered their APRs, which are higher than traditional loans but often lower than payday loans, making them an option for those with damaged credit. We also touched on who might find Net Credit suitable, what makes their service distinct, and the importance of understanding their terms of use, including session replay technologies. The aim was to provide a comprehensive overview to help readers determine if Net Credit aligns with their financial needs.

watercolor fishing net 16532784 PNG

Fishing Net PNG Clip Art - Best WEB Clipart - Clip Art Library

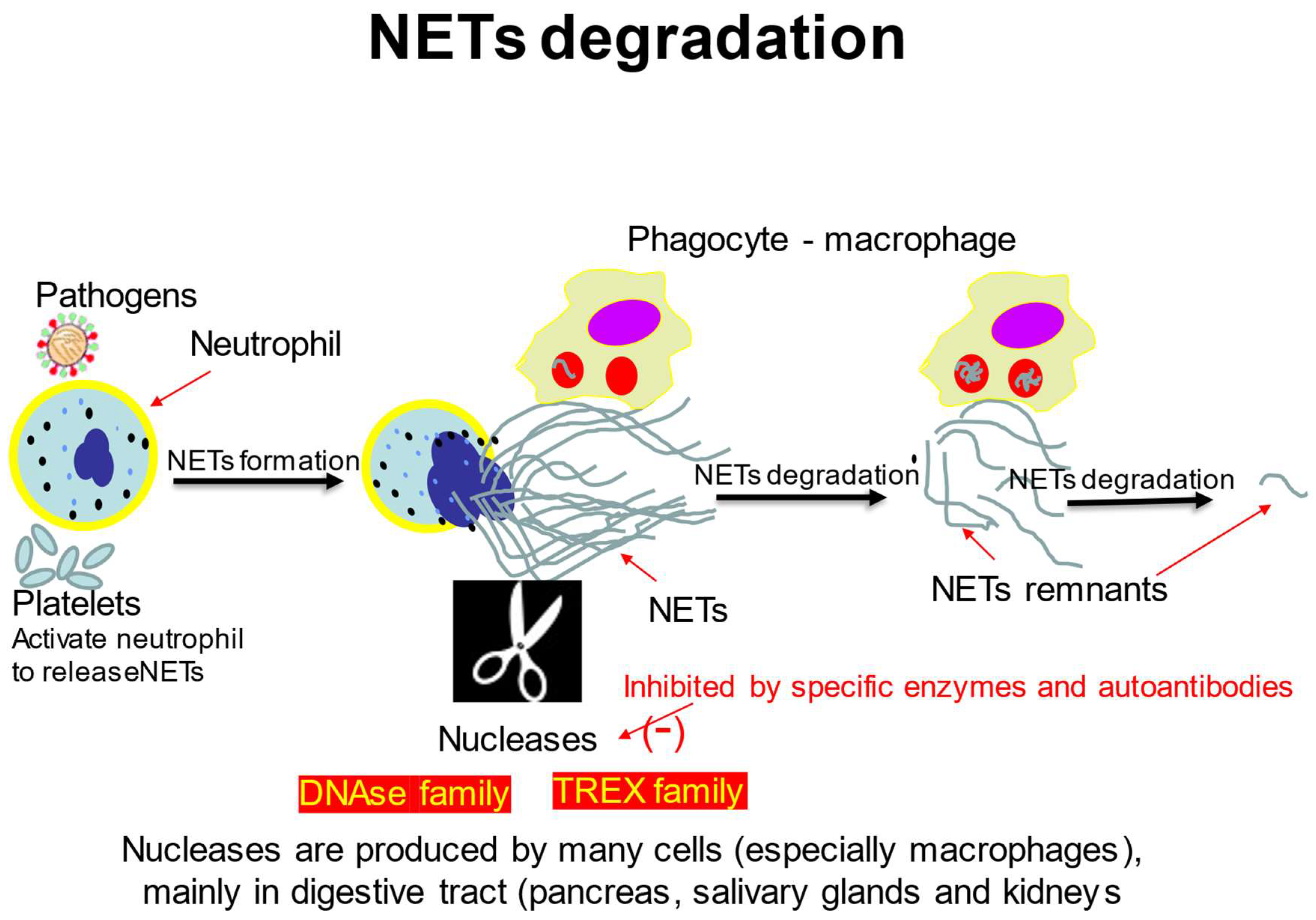

IJMS | Free Full-Text | Molecular Mechanisms of Neutrophil