Interactive Brokers - Your Money's Safe Place

When you are thinking about where to put your hard-earned money, especially with someone who helps you buy and sell things in the markets, it is really important to feel good about that choice. You want to know that the firm you pick is strong and steady, able to stand firm through both good times and the trickier moments that happen in the bigger financial picture, so, that peace of mind is something you really want to have.

This means looking for a company that has a long history of being reliable, one that shows it can handle whatever comes its way, whether the markets are up or down. You're basically searching for a partner who can be there for the long haul, helping you keep your funds secure, and that, is what many people look for.

A firm like Interactive Brokers, for example, has built a reputation for being a very solid choice, offering many tools and options that could just make your financial activities a bit smoother and more straightforward, as a matter of fact.

Table of Contents:

- Is Your Money Really Secure with Interactive Brokers?

- Getting Different Views with Interactive Brokers

- What Kinds of Trading Tools Does Interactive Brokers Offer?

- Keeping Your Interactive Brokers Account Safe

- Saving Money with Interactive Brokers - How Does That Work?

- Making Your Interactive Brokers Trades Go Faster

- Finding the Right Account for You at Interactive Brokers

- Trying Out Interactive Brokers for Yourself

Is Your Money Really Secure with Interactive Brokers?

It is a pretty big deal to trust a company with your savings or your investment funds, and you really want to be sure they can keep it safe, so, thinking about how secure a broker is, really matters. You need a place where your funds are protected, not just during calm periods, but also when the wider financial scene gets a bit bumpy. A strong broker, you see, can weather those storms, meaning your money has a better chance of staying put and being there when you need it. This kind of strength comes from being well-established and having proper backing, which helps them stay steady even when things get tough for others, you know? It's about having that assurance that the company you pick has the ability to last through good times and bad, providing a stable home for your financial efforts.

When you pick a broker, you are essentially choosing a guardian for your financial future, and it makes sense to pick one that has a proven track record of being reliable, very reliable, in fact. This means they are not just around for a quick profit, but they have the structure and the staying power to be a long-term partner for your money. Think about it like this: if a company can stand firm when the markets are swinging wildly, that says a lot about its foundation and how well it handles pressure. So, looking for a broker that shows this kind of endurance is a pretty smart move, as a matter of fact, because it gives you a lot more peace of mind about where your funds are sitting.

For example, Interactive Brokers LLC operates as a futures brokerage firm that is registered with the CFTC, which is a government body that oversees certain financial markets. This kind of registration means they follow specific rules and guidelines, adding a layer of official oversight to their operations, and that, is something you might want to consider. They are also a clearing member and connected with ForecastEx LLC, which shows their connections within the financial world and their ability to handle transactions properly. These affiliations and registrations are there to help make sure that the firm operates with a certain level of openness and follows established practices, providing a framework that helps protect those who put their money with them, you know?

Getting Different Views with Interactive Brokers

Many people find it helpful to get advice and insights from a few different sources when it comes to managing their money, so, exploring options with multiple advisors, brokers, and wealth managers can be a really good idea. It is like getting several opinions before making a big decision; each person might see things a little differently, giving you a more complete picture of what could work for your own situation. This approach helps you gather a wider range of ideas and strategies, which can be pretty useful for making choices that fit your personal goals, you know? It helps you avoid putting all your eggs in one basket, so to speak, when it comes to financial guidance, and that, is often a smart way to go about things.

When you consider working with different financial helpers, you open yourself up to various ways of thinking about money and investments, which can be very beneficial. One advisor might focus on long-term growth, while another might be more about protecting your funds, or maybe even finding ways to get a regular income. By talking to several of them, you can compare their ideas, see what feels right for you, and build a plan that feels truly personal. This sort of varied input can help you feel more confident about the choices you make, knowing you have looked at things from different angles, and that, can make a real difference in how you approach your financial path.

Interactive Brokers, it turns out, gives you a way to look at many advisor portfolios, including what are called smart beta portfolios, which are offered through Interactive Advisors, so, that's pretty handy. This means you can see how different financial professionals put together their investment plans, and you can even explore these specialized smart beta options that blend traditional investment ideas with a bit of a twist. It is like having a window into various investment strategies, allowing you to see what others are doing and how they approach the markets. This kind of access can be very helpful if you are trying to figure out what kind of investment approach might be a good fit for you, providing a lot of ideas to consider, as a matter of fact.

What Kinds of Trading Tools Does Interactive Brokers Offer?

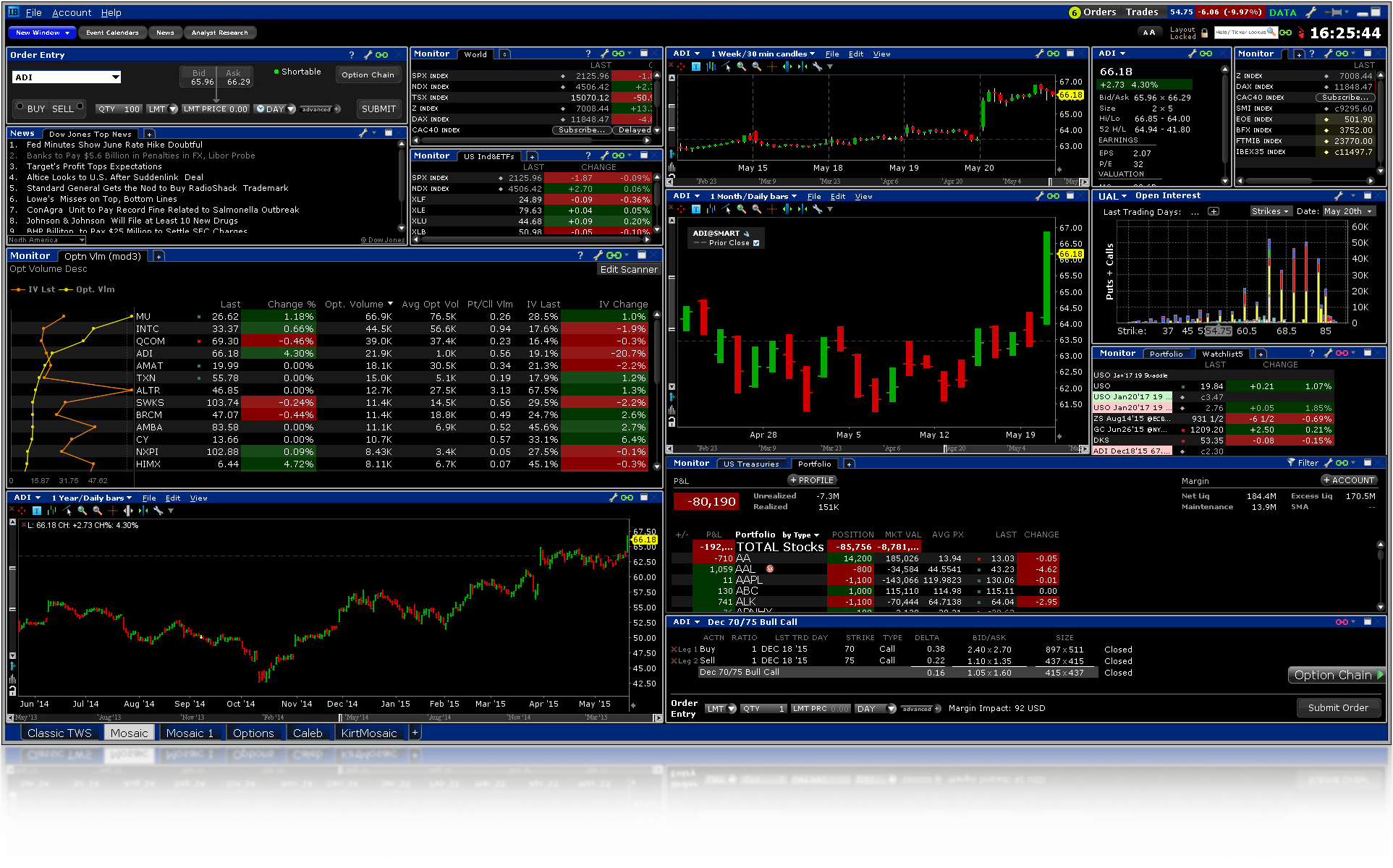

When you are looking to buy or sell things in the financial markets, having the right tools can make a big difference in how smoothly everything goes, so, it is good to know what is available. Interactive Brokers offers a selection of trading platforms that you can use, like the Client Portal, Trader Workstation, IBKR Desktop, and more, which means you have choices for how you want to manage your activities. Each of these platforms is set up to help you do different things, whether you are just checking your account, placing an order, or looking at market information in detail. They are there to support your financial efforts, giving you the means to act when you need to, and that, can be very useful for someone who trades often.

The Client Portal, for instance, is often seen as a straightforward way to get a quick look at your account and handle basic tasks, which is pretty convenient for everyday use. Then there is the Trader Workstation, which is known for having a lot of features for those who do a lot of trading and need more advanced options. IBKR Desktop is another choice, perhaps offering a good middle ground for many users, providing a solid experience for managing your funds and making trades. Having these different options means you can pick the one that feels most comfortable for you and that best fits the kind of trading you do, giving you flexibility, as a matter of fact.

These platforms are designed to help you with all sorts of trading tasks, from putting in a new order to keeping an eye on the ones you already have going, and even just looking at how your funds are doing. You can easily place orders, see what orders are currently open, and get a quick look at your overall situation. This ability to place orders quickly, manage them effectively, and view your account details all in one place can make the whole process much less complicated, which is pretty nice. So, having these sorts of tools at your fingertips can really help you stay on top of your trading activities, you know?

Keeping Your Interactive Brokers Account Safe

Keeping your account secure is a really important part of managing your money online, and it is something that every user should pay close attention to, so, knowing how to protect your Interactive Brokers account is a good idea. One way they help with this is by using a security code card for authenticating your identity when you log in. This is an extra step that makes it harder for someone else to get into your account, even if they somehow got hold of your password, and that, is a pretty strong layer of protection.

When you use this card, you will see two index numbers on an image, and for each of those numbers, you need to find the matching value on your physical card. Then, you simply enter those values into the requested fields. This method means that you need both your password and a piece of physical information that only you have, which makes it much more difficult for unauthorized people to gain access to your account. It is a system that adds a significant barrier against unwanted entry, giving you a better feeling of safety for your funds, you know? It is just another way they try to keep your money and personal information protected from others.

Saving Money with Interactive Brokers - How Does That Work?

One thing that often gets people's attention when they are looking for a broker is how much they have to pay in fees, so, it is good to know that Interactive Brokers is known for having trading fees that are on the lower side. This can make a real difference to your overall returns, especially if you trade often, because every little bit saved on fees means more money stays in your pocket. Beyond just trading fees, they also offer what are considered some of the better margin rates in the industry, which can be a big plus if you use borrowed funds for your trading activities. Lower margin rates mean you pay less for the money you borrow, which can really add up over time and make your trading more cost-effective, as a matter of fact.

The amount you pay in fees can really impact how much you end up with in your account, especially over many years of trading. Even small differences in fees can lead to big differences in your final balance, so, finding a broker with good rates is a pretty smart move. It is like finding a good deal on anything else; you want to get the most for your money, and with trading, that means keeping your costs down. The idea is to make sure that more of your financial gains are actually yours to keep, rather than going towards various charges, and that, is something many people are looking for when they pick a broker.

On top of that, Interactive Brokers actually pays interest on cash balances, which is a nice little bonus for those who keep money in their account. For example, they currently offer interest rates of up to 3.83% for US dollar balances, but there is a condition: you need to have an account with a net asset value of $100,000 or more to qualify for this. This means that even the money that is just sitting there, waiting to be used, can be earning a little something for you, which is a pretty good feature. It is a way for your money to work for you even when it is not actively invested, adding another small layer of potential gain to your overall financial picture, you know?

Making Your Interactive Brokers Trades Go Faster

When you are trading, especially in fast-moving markets, how quickly you can get your orders in and executed can be really important, so, being able to make your trades go faster and work more smoothly is a big plus. Interactive Brokers' Trader Workstation, which is a global trading system, is designed to help you with this, letting you use a set of online trading tools across more than 100 markets all over the world. This means you have the ability to act quickly when opportunities pop up, and you can do it efficiently, which can make a real difference to your trading results, you know?

The Trader Workstation gives you access to a wide array of tools that are meant to help you make decisions and place orders with speed and precision. Whether you are looking at market data, analyzing trends, or just trying to get your order filled at a specific price, these tools are there to support you. Being able to trade in so many different markets around the globe also means you have a lot of options for where to put your money, giving you a wider scope for your trading activities. It is like having a control center for your trades that can reach almost anywhere, allowing you to react to market changes very quickly, as a matter of fact.

With this system, you can also quickly place orders, keep an eye on any orders you have open, and see all your trading details in one spot. This makes the whole process of buying and selling much more straightforward and less time-consuming. Imagine being able to put in an order in just a few clicks, then easily check its status without having to search around. That kind of ease and speed can be incredibly helpful for anyone who trades regularly, helping them stay on top of their positions and react to market movements without delay, which is pretty useful.

Finding the Right Account for You at Interactive Brokers

Picking the right kind of account is a pretty important first step when you are getting started with a broker, so, it is good that Interactive Brokers offers an account guide to help you find the one that fits your needs. This guide helps you go through the details for different kinds of accounts, like individual accounts for one person, joint accounts for two or more people, IRA accounts for retirement savings, and trust accounts, which are for managing funds on behalf of others. Having a variety of choices means you can pick the account structure that best suits your personal or family situation, and that, is something many people appreciate.

Beyond just the type of account, these options also come with flexible base currencies, which means you can choose the main currency your account operates in. This can be really helpful if you deal with money in different countries or if you prefer to manage your funds in a currency other than the US dollar, for example. It adds a layer of convenience for people who have international financial activities or simply want to keep their money in a currency they are most comfortable with. So, whether you are planning for retirement, managing funds with a partner, or setting up something for a trust, there is likely an account type that will work well for you, as a matter of fact.

Interactive Brokers LLC also provides access to ForecastEx forecast contracts for customers who are eligible, which is another specific offering for those interested in that particular type of financial product. It is worth noting, however, that Interactive Brokers LLC does not give recommendations about any products. This means they provide the tools and the access to various financial instruments, but they do not tell you what to buy or sell. You are in charge of your own choices, and they are there to help you carry out those choices, which is pretty important to keep in mind, you know?

Trying Out Interactive Brokers for Yourself

Before you make a big change, it is often a good idea to try things out and see how they compare to what you are used to, so, it is helpful that Interactive Brokers offers a free trial. This gives you a chance to look at their commissions, their margin rates, and their low financing charges, and then you can put them side-by-side with what your current broker charges you. It is a way to really see, firsthand, if switching could save you some money, which is pretty compelling for many people.

The free trial lets you get a feel for how things work without having to commit fully, and that, can be a great way to make an informed decision. You can actually calculate how much more you might be able to keep in your own account if you were to open an account with them. This kind of direct comparison can highlight potential savings that you might not have realized were possible, making it clear what benefits you could gain by making a move. So, it is a straightforward way to explore if an Interactive Brokers account could be a better fit for your financial needs and help you hold onto more of your funds, you know?

Interactive Brokers ®, IB SM, interactivebrokers.com ®, Interactive Analytics ®, IB Options Analytics SM, IB SmartRouting SM, PortfolioAnalyst ®, IB Trader Workstation SM and One.

Interactive Brokers ®, IB SM, interactivebrokers.com ®, Interactive Analytics ®, IB Options Analytics SM, IB SmartRouting SM, PortfolioAnalyst ®, IB Trader Workstation SM 和One.

Interactive Brokers ®, IB SM, interactivebrokers.com ®, Interactive Analytics ®, IB Options Analytics SM, IB SmartRouting SM, PortfolioAnalyst ®, IB Trader Workstation SM y One.

Interactive Brokers Review (Official) | StockBrokers.com

Global Trading Platform - IB Trader Workstation | Interactive Brokers LLC

Interactive Brokers Python API (Native) - A Step-by-step Guide